In the quick-evolving landscape of digital banking, Zen.Com stands proud as a trailblazer, redefining the way corporations manipulate their financial transactions. In this blog submission, we will take a better examination of the prominence of Zen.Com within the digital banking sphere and delve into the critical position that service provider accounts play in contemporary banking surroundings.

A Glimpse into Zen.Com’s Digital Banking Excellence

Zen.Com has firmly mounted itself as a pacesetter in the digital banking realm, presenting modern answers that cater to the evolving needs of groups. With a dedication to simplicity, performance, and safety, Zen.Com has ended up as a cross-to platform for corporations looking for a current and dependable economic partner.

Merchant Accounts: Cornerstones of Financial Transactions

Merchant debts function as the spine of monetary transactions for agencies, acting as specialized bank debts that facilitate the seamless processing of payments. In the ever-expanding virtual panorama, the significance of service provider debts can’t be overstated. They allow corporations to simply accept payments via numerous channels, which include credit playing cards, virtual wallets, and online transfers.

Understanding Merchant Accounts with Zen.Com

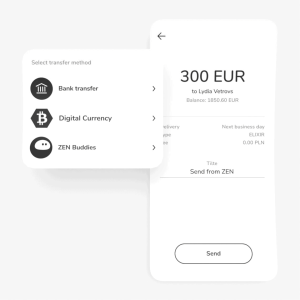

At the center of Zen.Com’s offerings are its latest merchant debts, designed to satisfy the diverse needs of agencies in the modern era. Let’s ruin down the fundamentals:

- Definition and Purpose: Zen.Com’s merchant bills are specialized accounts that empower businesses to accept and manipulate payments securely.

- Traditional vs. Digital: Distinguishing between conventional and virtual service provider debts, Zen.Com brings a forward-thinking technique that aligns with the digital age, getting rid of the constraints of previous banking practices.

- Modern-Era Importance: In the present-day rapid-paced business environment, having a strong merchant account isn’t always simply an option; it is a necessity for companies aiming to thrive in the digital marketplace.

Zen.Com’s Approach to Merchant Accounts: A Holistic View

Zen.Com’s merchant account services are designed to simplify and elevate the monetary revel for businesses. Here’s a closer observation of what sets Zen.Com aside:

- Overview: Zen.Com provides a complete suite of merchant account answers, catering to agencies of all sizes and industries.

- Key Features and Benefits: From competitive transaction prices to advanced security functions, Zen.Com’s service provider accounts include quite a number of blessings geared toward improving the monetary well-being of organizations.

- Simplified Processes: Zen.Com is familiar with the complexities companies face, and its person-pleasant technique guarantees getting and dealing with service provider debts in a trustworthy manner.

The Advantages of Zen.Com’s Merchant Accounts in Action

Let’s discover how Zen.Com’s service provider money owed translates into tangible blessings for agencies:

- Streamlined Payment Processing: Zen.Com complements transaction performance, ensuring that companies can manner bills seamlessly, main to improved coin drift and consumer satisfaction.

- Robust Security Measures: Security is a pinnacle priority for Zen.Com. Businesses can perform with self-belief, knowing that their transactions are safeguarded with the aid of current safety protocols that protect each trader and client.

- Integration Capabilities: Zen.Com’s service provider bills seamlessly combine with numerous systems, providing businesses with flexibility and the potential to conform to changing technological landscapes.

Case Studies: Real Stories of Success

To illustrate the effect of Zen.Com’s merchant debts, allow’s delve into actual-existence case research offering agencies that have skilled transformative effects. These achievement tales highlight stepped forward payment processing, heightened protection, and universal business increase because of Zen.Com’s economic answers.

Tips for Maximizing Zen.Com’s Merchant Account Benefits

For agencies trying to extract the maximum cost from Zen.Com’s service provider money owed, here are some sensible hints:

- Best Practices: Explore the great practices for using Zen.Com’s service provider accounts to their full potential, ensuring premier financial management.

- Payment Flow Optimization: Receive steerage on optimizing price flows, enhancing operational performance, and minimizing capacity bottlenecks.

- Additional Features: Uncover the whole spectrum of functions offered with the aid of Zen.Com’s service provider accounts and learn how agencies can leverage these competencies to their advantage.

Common FAQs: Addressing Your Queries

In this section, we address commonplace questions and worries related to Zen.com’s service provider debts. Whether you are a seasoned enterprise proprietor or a startup entrepreneur, find readability on inquiries that depend most on you.

Conclusion: A Seamless and Secure Financial Future with Zen.Com

As we wrap up our exploration of Zen.Com’s service provider money owed, it is glaring that this digital banking powerhouse is paving the manner for corporations to thrive in a more and more interconnected world. The recap of key points emphasizes how Zen.Com’s service provider debts contribute to a seamless and steady financial enjoyment for businesses, marking a transformative breakthrough inside the realm of digital banking.

Zen.Com Is a pinnacle Virtual Bank account in the World. Manage your money freely with payments and ZEN Mastercard® related directly to … Accept bills in ZEN fashion. … Payment gateway with a banking account. Cards ZEN Mastercard …

A card made to pay; ZEN Care – shopping protection; one year.ZEN Pricing Business Lowest expenses for the most popular payment techniques.

ZEN is ready to start taking payments right inner your present eCommerce platform. There’s no want to conflict with code or upload fee methods in my view – simply set up the payment plugin to combine the payment gateway and automate the whole manner.

No need for IT support. No hassle. Just the fastest, easiest way to integrate the depended-on-fee techniques your clients need.

This Product

ZEN Mastercard®

Simple and delightful bodily and digital ZEN cards are made to bring you a nice buying enjoy. Stay in control, always be secure, and be privy to your spending.

You can join them with Google Pay and Apple Pay for the maximum convenient bills.

“Discover financial tranquility with Zen.com bank’s Merchant Accounts. Elevate your business transactions with seamless, secure, and efficient solutions. Experience the calm of streamlined payments and elevated financial peace.”

Be the first to review “Buy Zen.com Bank With Marchant Accounts”